Have you ever felt like your budget is, well, getting a little stretched? You might be experiencing what some folks playfully call 'inflation butt.' It's a vivid way people talk about the real-life feeling when your money just doesn't go as far as it used to. This isn't about physical changes, you know, but more about the uncomfortable squeeze on your finances.

Prices have been going up, and that, is that, something many of us are noticing more and more. It’s in the headlines because it has been rising at the fastest pace for several years across many countries. This trend touches everything, from what you pay at the grocery store to the cost of filling up your car.

So, what exactly is this 'inflation butt' feeling all about? It’s a way of expressing the collective pressure people feel as the cost of living keeps climbing. It’s a big topic, too it's almost, that's getting a lot of attention from everyday people and economic experts alike.

Table of Contents

- What is 'Inflation Butt'?

- The Roots of Rising Prices

- How Inflation Touches Your Daily Spend

- Coping with the Squeeze

- Looking Ahead: Economic Outlook

- Frequently Asked Questions

- Final Thoughts

What is 'Inflation Butt'?

The phrase 'inflation butt' might sound funny, but it really points to a serious worry many people share. It’s not a formal economic term, of course, but a relatable way to talk about the impact of money losing its buying power. When prices for common goods and services go up, our wallets feel a bit lighter, don't they?

Understanding the Term

Inflation is the term used to describe the rate at which prices increase, as a matter of fact. When we talk about 'inflation butt,' we're getting at the discomfort or strain that comes with this increase. It’s the feeling of having less financial wiggle room, which can be pretty frustrating for families and individuals.

This feeling, you know, is a direct result of the economy changing. Your usual grocery trip might suddenly cost more, or the price of gas for your commute might be a bit of a shock. It’s these daily experiences that give rise to such a descriptive, if informal, phrase.

Why It Matters to You

So, why should you care about this idea of 'inflation butt'? Well, it matters because it directly affects your household budget and your plans for the future. When money buys less, it means you have to make different choices about spending and saving, which can be tough.

For instance, if your income stays the same but prices rise, your real buying power goes down. This can lead to tough decisions about what to cut back on, or how to stretch your earnings further. It’s a very real challenge that people face every single day, virtually.

The Roots of Rising Prices

Understanding why prices are going up helps us make sense of the 'inflation butt' feeling. There are many reasons for these changes, and they often involve big picture economic events. It’s not just one thing, but a mix of factors that create this situation, typically.

Global Economic Shifts

The global economy was front and centre in 2024, as leaders grappled with challenges like inflation, multiple elections and the intelligent age. These large-scale events can have ripple effects that reach right down to your local store. Things happening far away can influence the cost of goods you buy, surprisingly.

For example, issues with supply chains or changes in international trade can make goods more expensive to produce and transport. These added costs often get passed on to consumers, leading to higher prices. It’s a complex web of connections, you know, that impacts us all.

Historical Context

History offers some clues, too, about what might be happening now. Anticipation has grown for an onset of 'stagflation,' a toxic blend of deteriorating growth and rising inflation, in the US and elsewhere. We’ve seen similar periods before, for instance, in the 1970s.

Dismal stagflation in the 1970s forced a lot of changes in how economies were managed. Looking back helps economists and governments think about ways to handle current situations. It’s a reminder that these economic patterns have happened before, and we can learn from them, basically.

How Inflation Touches Your Daily Spend

The 'inflation butt' feeling is most noticeable in our everyday spending. It’s where we directly experience the impact of rising prices. From the kitchen table to the gas pump, these changes add up quickly, sometimes just a little, sometimes a lot.

Food and Energy Costs

Inflation is on the increase around the world, with food and energy prices hitting record highs. This means that two of the most basic necessities for living are becoming more expensive. It can make a significant difference to a household's weekly budget, you see.

Think about your grocery bill. If the cost of bread, milk, or vegetables goes up, it directly affects how much you spend each week. Similarly, higher prices for gasoline or electricity mean your utility bills might be bigger. These are very tangible ways inflation makes itself felt, obviously.

Everyday Purchases

It’s not just big ticket items or major necessities, though. Even small, everyday purchases can reflect the creep of inflation. That morning coffee, a favorite snack, or a new pair of socks might all cost a bit more than they did last year, for example.

These small increases, when added together, can really start to pinch. It makes people think twice about casual spending, or look for cheaper alternatives. This shift in spending habits is a clear sign that the 'inflation butt' is making its presence known, in fact.

Coping with the Squeeze

So, what can you do when you feel that 'inflation butt' squeeze? There are practical steps you can take to manage your money more effectively during times of rising prices. It’s about being smart and adaptable with your financial habits, you know, to help ease the pressure.

Smart Money Moves

One good step is to really look at where your money is going. Creating a detailed budget can help you see exactly what you’re spending on. Then, you can identify areas where you might be able to cut back or find savings, perhaps by cooking more at home instead of eating out, for instance.

Another idea is to look for ways to boost your income, if possible. This could mean taking on a side gig, or negotiating for a pay raise at your current job. Every little bit helps to offset the rising cost of living, honestly.

Consider shopping around for better deals, too. Compare prices at different stores for groceries, or look into changing utility providers. Even small changes can add up over time and help you save a few bucks, you know.

Planning for the Future

Thinking long-term can also help ease the 'inflation butt' feeling. Inflation is an important indicator of an economy’s health, and understanding this helps us plan. It’s about making choices that can protect your financial well-being over time, sort of.

This might involve reviewing your savings and investment strategies. Some types of investments might perform better during periods of inflation. It’s a good idea to talk to a financial advisor who can offer guidance specific to your situation, at the end of the day.

Also, building up an emergency fund is more important than ever. Having a cushion of savings can provide peace of mind when unexpected expenses pop up, especially when prices are unpredictable. It’s a pretty smart move for anyone, really.

Looking Ahead: Economic Outlook

While the 'inflation butt' feeling is real for many, it's also true that economic situations can change. Experts are always looking at the data to figure out what might happen next. It's a continuous process of observation and analysis, obviously.

Expert Insights

Governments and central banks use the CPI and other indices to make economic decisions. These decisions are aimed at keeping the economy stable and prices under control. The may 2025 chief economists outlook explores key trends in the global economy, including the latest outlook for growth, inflation, monetary and fiscal policy, too it's almost.

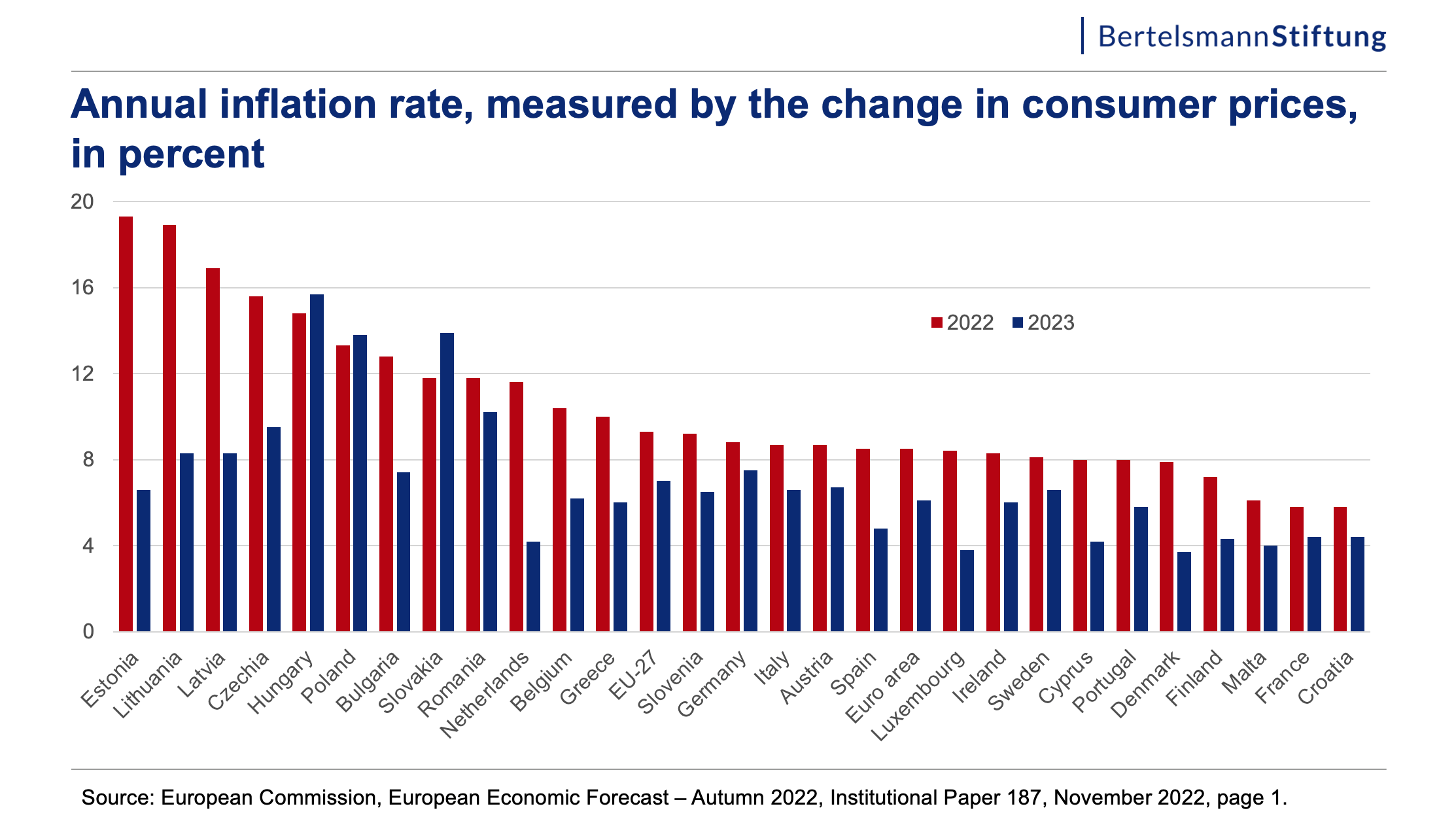

The inflation rate in the US has been on the rise in recent years, reaching a high of 8.3% in 2022. This kind of data helps economists understand the scope of the challenge. They look at these numbers to predict future trends and suggest possible actions, basically.

Mena faces rising inflation, climate crises and conflict in 2025 but opportunities in digitalization, economic diversification and cooperation offer hope. This shows that even with challenges, there are always areas where positive change can happen. It's not all gloom and doom, you know.

Signs of Change

The january 2025 edition of the chief economists outlook reveals a global economy under considerable strain. While inflation is easing in most regions, uncertainty remains elevated and that, is that, something to keep in mind. This means things are still a bit up in the air, but there are positive signs.

It’s a mixed picture, with some areas seeing improvement and others still struggling. This highlights the complex nature of global economics. We need to stay informed and ready for shifts, pretty much, as the situation develops.

Key among these is whether to adjust financial strategies as economic conditions evolve. Staying aware of these broader trends can help you make more informed personal financial choices. It’s about keeping an eye on the bigger picture, you know, while managing your own budget.

Frequently Asked Questions

Here are some common questions people have about inflation and its effects:

What does 'inflation butt' really mean for me?

It means you might feel a pinch in your spending power, as your money buys less than it used to. It's a casual way to talk about the financial strain from rising prices, honestly. Your budget might feel tighter, and you might need to adjust your spending habits.

How does inflation change spending habits for most people?

When inflation hits, people often start looking for ways to save money. This could mean cutting back on non-essential items, seeking out sales, or choosing cheaper brands. It tends to make folks more careful with their cash, you know, and more focused on necessities.

What can I do about rising prices in my daily life?

You can try creating a budget, looking for ways to reduce expenses, or exploring options to increase your income. Saving money where you can, like by cooking at home or finding cheaper transportation, can help ease the burden, you know, quite a bit.

Final Thoughts

Understanding the 'inflation butt' phenomenon means recognizing the real impact of rising prices on your daily life. It’s about being aware of economic trends and taking steps to protect your financial well-being. To learn more about economic shifts and how they might affect you, visit our site. You can also find helpful information about managing your household finances in uncertain times. Staying informed is a pretty powerful tool for everyone.

Detail Author:

- Name : Omer Wilkinson

- Username : ian.schuster

- Email : sgottlieb@gmail.com

- Birthdate : 1993-11-18

- Address : 6675 Lilyan Points Suite 475 Stromanborough, TX 83083

- Phone : +13127937491

- Company : Harris-Thompson

- Job : Glazier

- Bio : Reiciendis quia illo provident voluptates. Dolorem nemo est qui non qui minus. Et repellendus sed distinctio ut. Nostrum excepturi quidem est odio quos tempore optio.

Socials

instagram:

- url : https://instagram.com/maybell_huel

- username : maybell_huel

- bio : Est dolores nemo laudantium non culpa ex. Voluptas aut quam vel officiis deleniti dolorem quos.

- followers : 6399

- following : 2801

twitter:

- url : https://twitter.com/huel2023

- username : huel2023

- bio : Fugiat rerum exercitationem eos. Quaerat nihil recusandae id deleniti modi. Quia odit exercitationem et qui consequatur molestias.

- followers : 4669

- following : 1029

tiktok:

- url : https://tiktok.com/@huelm

- username : huelm

- bio : Magni enim dicta qui ullam laudantium.

- followers : 5687

- following : 2010

facebook:

- url : https://facebook.com/maybell.huel

- username : maybell.huel

- bio : Aperiam similique quas minima enim odio aperiam.

- followers : 3455

- following : 2594

linkedin:

- url : https://linkedin.com/in/maybellhuel

- username : maybellhuel

- bio : Omnis eos dolorem id velit deleniti.

- followers : 6221

- following : 1530